Local economy remains strong, but slowing, economist says

The Texas and Houston-area economies are slowing in part because of elevated inflation and rising interest rates, along with a slowing global economy and uncertainty over the Russia-Ukraine war, an economist said.

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continue |

Local economy remains strong, but slowing, economist says

The Texas and Houston-area economies are slowing in part because of elevated inflation and rising interest rates, along with a slowing global economy and uncertainty over the Russia-Ukraine war, an economist said.

Luis B. Torres is a senior business economist in the research department of the Federal Reserve Bank of Dallas. He presented his findings at a May 18 economic forecast session sponsored by the Katy Area Chamber of Commerce. The meeting took place at the chamber headquarters, 814 East Ave., Suite G.

Despite the slowing economy, Torres said, the early 2023 Texas job growth rate remains strong. The current job growth rate is 3.9% in Texas, compared to 2.2% nationally. These moderate rates are highlighted both by a downturn in high-wage service sectors and continued weakness in the manufacturing sector, he said.

In terms of Texas markets, the Dallas-Fort Worth metro job growth is the strongest in the state, at 30.4%. The Houston area is second, at 24.1%. Austin (9.4%) and San Antonio (8.3%) follow.

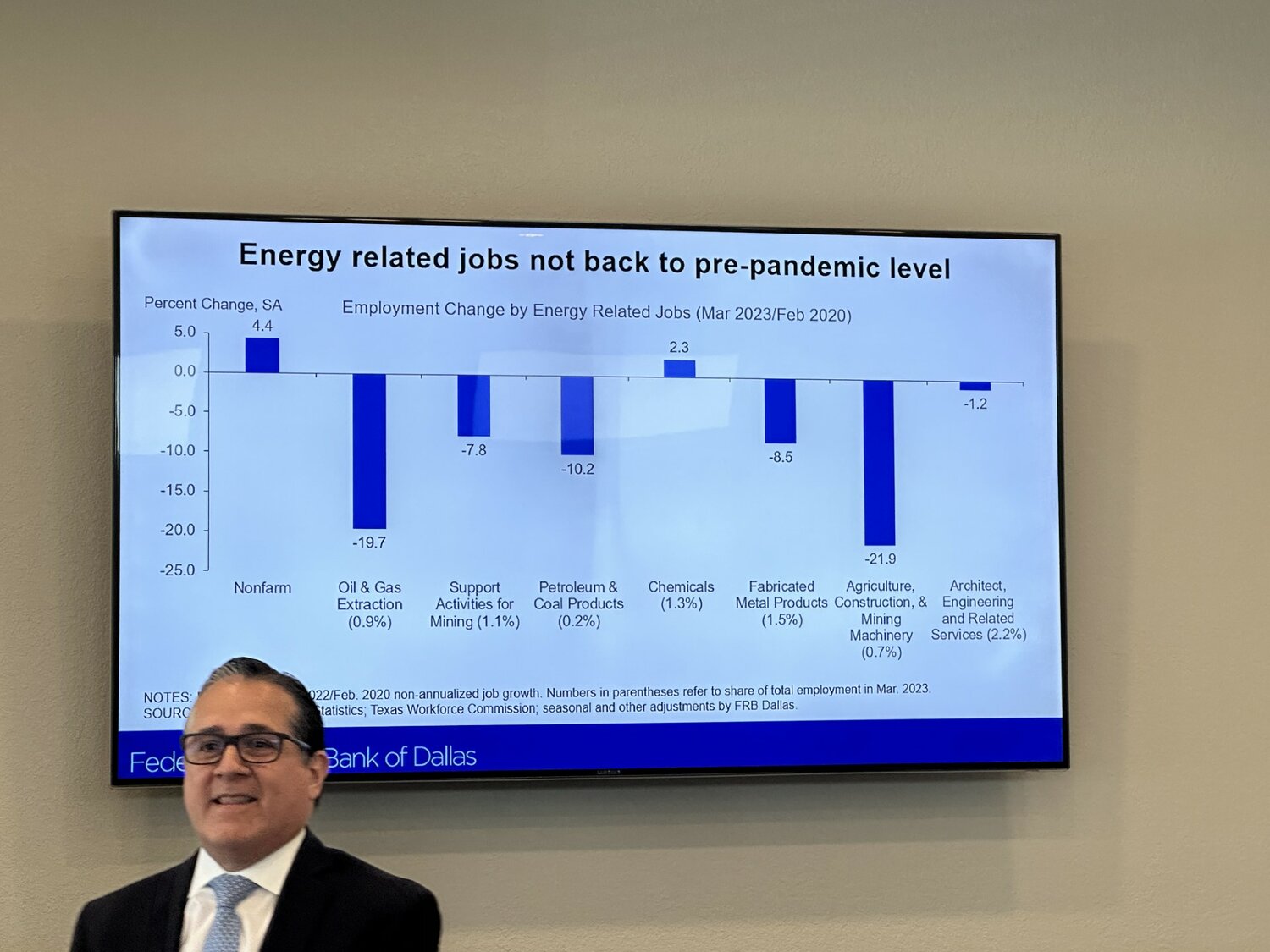

Yet despite this growth in jobs, Torres said, energy related jobs are not yet back to their pre-pandemic level. Only two energy-related categories—non-farm and chemicals—have seen job growth. Other categories, most notably oil and gas extraction and agriculture, construction and mining machinery, have suffered the most losses, he said.

The outlook there isn’t likely to change, according to a March survey of 137 oil and gas firms. According to this survey, Torres said, over half of those surveyed said they expected the employment in oil and gas firms to remain the same. About 40% oof those surveyed said they expected to see a slight increase in employment in oil and gas firms, Torres said.

The energy sector, while important, isn’t the only sector economists are following. In the Houston metropolitan area, he said, five sectors have had double-digit percentage growth. They are trade, transportation and utilities (20.5%), professional and business services (16.8%), education and health services (13.2%), government (13.2%) and leisure and hospitality (10.4%).

As of February, Torres said, private sector average hourly earnings in Austin ($33.86) and San Antonio ($27.78) have leveled off while Fort Worth ($33.78), Dallas ($33.51), Houston ($33.03) have all gone up.

The U.S. ($33.22) and the Texas ($31.15) average hourly earnings have also been rising. The U.S. figure was as of March, while the Texas figure was as of February, Torres said.

Looking forward, Torres said, according to the Texas Economic Forecast, jobs in Texas will increase by 2.4% this year. The trend reflects a steady decline, from 4.8% in January and 6.1% in January 2022, he said.

The growth forecast comes as a Federal Reserve Bank of Dallas survey indicates that industry executives expect the industry to continue slowing down and the price of a barrel of oil falls from $108, in the second quarter of 2022, to an expected $80 this year. As of press time, the price of a barrel of oil was at $73.

Keywords

Federal Reserve Bank of Dallas, Katy Area Chamber of Commerce