A Historic Opportunity to Shape the Future of Texas

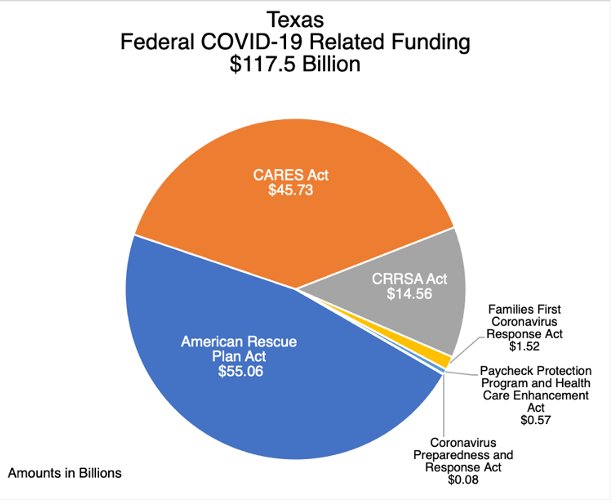

$117.5 billion.

That’s the amount that Texas state and local governments and educational institutions are expected to receive through federal stimulus legislation passed in response to the …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continue |

A Historic Opportunity to Shape the Future of Texas

$117.5 billion.

That’s the amount that Texas state and local governments and educational institutions are expected to receive through federal stimulus legislation passed in response to the COVID-19 pandemic. The total is more than what the U.S. invested in the Marshall Plan to rebuild Europe after World War II, even adjusted for inflation.

This massive investment will not only help restore Texas’ economy — it also provides a rare chance to prepare for the state’s future in a way that benefits the next generation of Texans.

With billions of dollars available for everything from parks to IT needs to energy investments, state leaders need to create a comprehensive, far-sighted strategy that ensures Texas can make the most of this generational opportunity.

The stimulus funds will flow through six Congressional Acts, with the lion’s share coming from:

- The Coronavirus Aid, Relief, and Economic Security (CARES) Act,

- The Coronavirus Response and Relief Supplemental Appropriations Act(CRRSAA), and

- The American Rescue Plan Act.

(Additional funds would come to Texas through the infrastructure bill that Congress is considering.)

The $1.9 trillion American Rescue Plan Act (ARPA) is especially significant. The legislation includes of $350 billion for state and local governments that will be funded through the State and Local Fiscal Recovery Fund. This funding is unique in that it comes with few strings — state and local governments have great flexibility to address the pandemic’s effects.

Texas state and local governments will receive $26.3 billion from the Fiscal Recovery Fund – $15.8 billion will flow to the state, and $10.5 billion will come to local governments.

Fiscal Recovery Fund dollars can be used for:

- Public health emergency & economic response

- Premium pay for essential workers

- General government services (covering government revenue that has been reduced through the pandemic); and

- Water, sewer, and broadband infrastructure.

(They cannot be used for tax cuts or pension fund deposits.)

Of those four, the general government services category offers the most flexibility. It means Fiscal Recovery Fund money can go toward any service deemed appropriate by the government that receives it, though the amount expended can’t exceed the estimated revenue lost to the pandemic.

Of the state’s $15.8 billion Fiscal Recovery Fund allocation, Texas 2036 estimates that up to $12.2 billion can be used for government services. That includes IT needs, state parks and facilities, energy investments, and other priority areas that can help fuel Texas’ economic recovery.

It goes without saying that some of this money will need to help address the current rise in COVID cases. In deciding how to deploy the amount that remains — and, really, in allocating all of the pandemic recovery funds that the state has direct or indirect discretion over — Texas 2036 recommends the state adopt these guiding principles:

- Target Long-Term Solutions: Again, this funding presents a generational opportunity to solve major policy challenges facing Texas. State leaders should pursue prudent, data-driven investments that will positively impact our state for decades to come, spur economic growth, and reduce future costs.

- Seek Financial Sustainability: This money represents a temporary cash infusion, not an ongoing revenue source. As such, the state should focus on one-time costs or expenses that can be covered through long-term savings.

- Coordinate Efforts to Maximize Impact: Governments, agencies and private sector organizations can make the biggest difference by working together. Leveraging investments across multiple jurisdictions — including cities, counties, school districts, businesses, and the philanthropic community — will ensure that coordinated strategies can efficiently address systemic problems.

These crucial steps will set the stage for the state’s future: on March 2, 2036, the day Texas turns 200, there will be nearly 10 million more people who call this place home. By comparison, about 7.5 million people live in the Dallas-Fort Worth area today. So, Texas has 15 years to fold another North Texas — and then some —into the economy.

These new Texans will need schools, workforce initiatives, health care, roads, parks, broadband internet connections, and efficient government services, just as we do today. This funding can help meet those needs and provide a transformative foundation for our state’s future growth.

It just requires good planning and a strong focus on the future.

A.J. Rodriguez is Executive Vice President of Texas 2036. Luis Acuña is a Texas 2036 Policy Analyst.

Keywords

Texas 2036, CARES Act, Federal Funding