Katy-area at legislators discuss priorities for upcoming session

Area state legislators said they will focus on keeping property taxes under control and improving public education in a Nov. 15 panel discussion at the Katy Area Economic Development Council.

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continue |

Katy-area at legislators discuss priorities for upcoming session

Area state legislators said they will focus on keeping property taxes under control and improving public education in a Nov. 15 panel discussion at the Katy Area Economic Development Council.

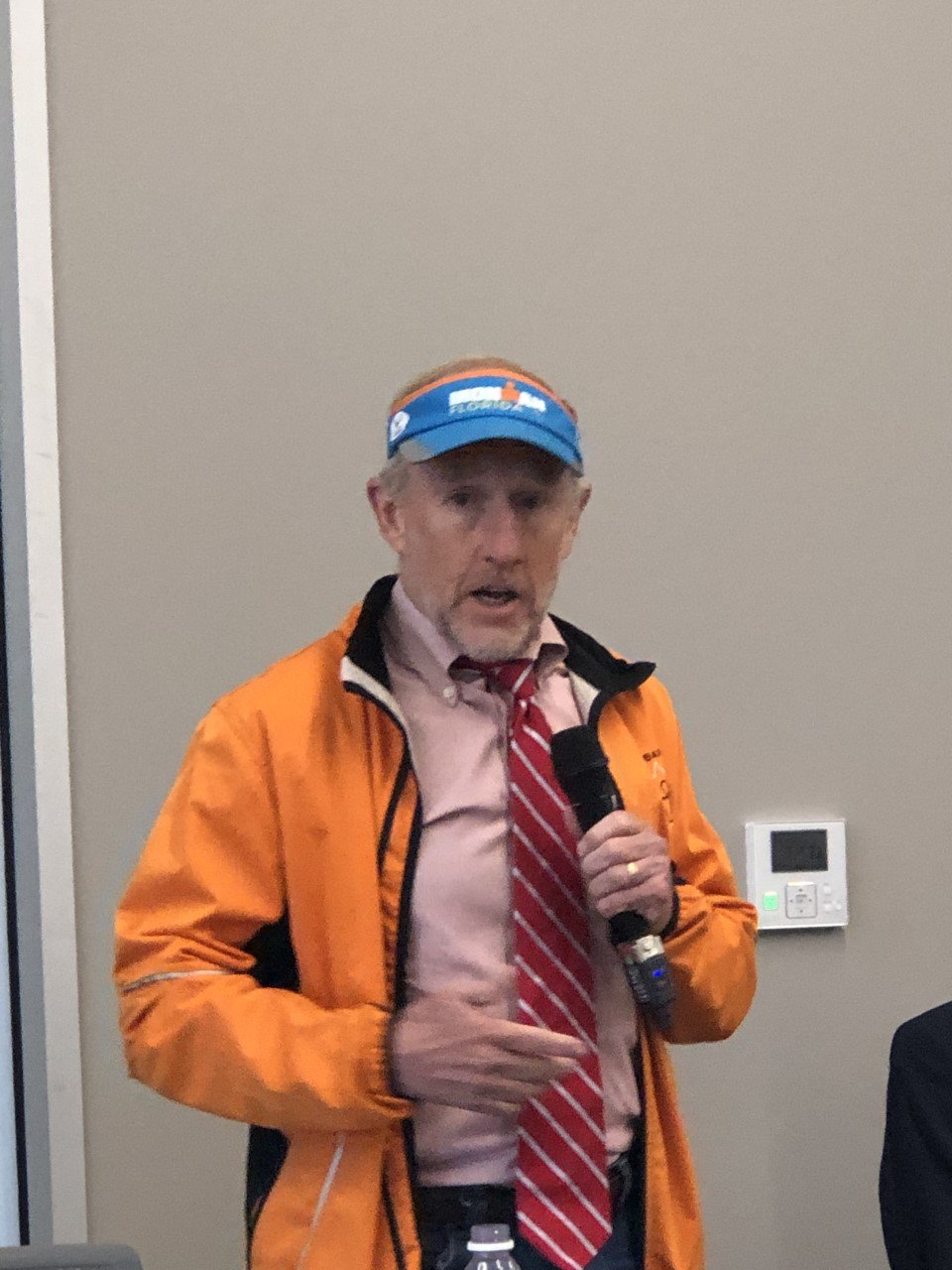

State Reps. Jacey Jetton, Gary Gates, Mike Schofield and Jon Rosenthal were the panelists. All represent a different part of Katy in their respective legislative districts. Jetton and Gates are from Fort Bend County. Schofield and Rosenthal are from Harris County. Jetton, Gates and Schofield are Republicans. Rosenthal is a Democrat. All won re-election Nov. 8.

Jetton said he would work to support public education, parent empowerment and school funding.

“I think this next session there will be a lot of conversations about education,” Jetton said.

The state is expected to have an approximately $27 billion budget surplus for the upcoming session, which begins in January. Schofield said when people read the comptroller’s report, they would see that that figure is due to inflation. The money is not there because the state has grown, he said.

“It’s not extra wealth and we need to return a lot of it,” Schofield said.

How the legislature will use that money will be used will be a key issue. There is conversation of using the money to help draw down property taxes, and Jetton said it was an issue in recent school district tax ratification elections, called TREs. Katy ISD voters rejected a proposed TRE in the Nov. 8 election.

“People feel the strain of property taxes and were going to have to continue working on that,” Jacey said.

Schofield said in a fast-growth areas such as Katy, “there’s no point in doing all these other wonderful things if people have to move away” because they cannot afford higher property taxes. He said he hoped to find a systemic way to keep property taxes from running people out of their homes.

Schofield said he has knocked on many doors during his campaigns, and people tell him that while they’re supporting him, they were planning to retire in a few years and move to other places, such as Northern Arkansas, because they cannot afford local property taxes.

“It is fundamentally not the business of your government to tax you out of your home,” Schofield said.

Schofield said another goal of his is to pass legislation that would improve clarity in the language read by voters on such matters as state constitutional amendments. Often such language can be misleading and that needed to stop, Schofield said.

Gates said the Texas education system does not do a good job of preparing kids for work and who are not going to college. Trades like welding, carpentry, plumbing and HVAC bring good salaries, and in some cases up to six figures, he said.

Gates said he wanted to work to bring vocational training back into the school system and into community colleges. He admitted, however, it might take a while to happen.

“It may take a couple of sessions,” Gates said.

Rosenthal described himself as the lone progressive on the panel. Yet property taxes would be a focus for him just as it is for his colleagues, he said.

Rosenthal said while Texas has no state income tax—there is a state constitutional amendment banning it—the average Texas taxpayer pays more in taxes than the average taxpayer in California, where there is a tax. This is a problem, he said.

Keywords

Katy Area EDC, Texas Legislature