City adopts $54.8 million budget for 2022-23

The Katy City Council Monday adopted a $54.8 million budget for 2022-23, and a $0.44 per $100 property valuation to pay for it.

City officials said 84% of the city’s revenue comes from …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, or purchase a new subscription.

If you are a current print subscriber, you can set up a free website account and connect your subscription to it by clicking here.

If you are a digital subscriber with an active, online-only subscription then you already have an account here. Just reset your password if you've not yet logged in to your account on this new site.

Otherwise, click here to view your options for subscribing.

Please log in to continue |

City adopts $54.8 million budget for 2022-23

The Katy City Council Monday adopted a $54.8 million budget for 2022-23, and a $0.44 per $100 property valuation to pay for it.

City officials said 84% of the city’s revenue comes from three sources. These are property tax (40%), sales tax (38%) and services (5%).

The property tax rate is a decrease from the $0.447168 per $100 property evaluation from last year. However, property tax revenue will increase by about $1.1 million, a 7% increase from the 2022 fiscal year. Officials said this increase is based on increased taxable property, and higher property valuations.

City Administrator Byron Hebert said sales taxes for 2022 outperformed the projected budget amount. But when unveiling the budget earlier this month, he said opportunities to develop more sales tax revenue are becoming more limited.

“The current projection of sales tax for fiscal year 2023, at $14,905,586 remains conservative under the looming economic recession and consequences of instability in Europe due to war,” Hebert wrote.

The budget calls for $40 million in general fund revenues, $9.9 million in enterprise fund revenues, $3.4 million in debt service revenues and $1.5 million and hotel occupancy revenues.

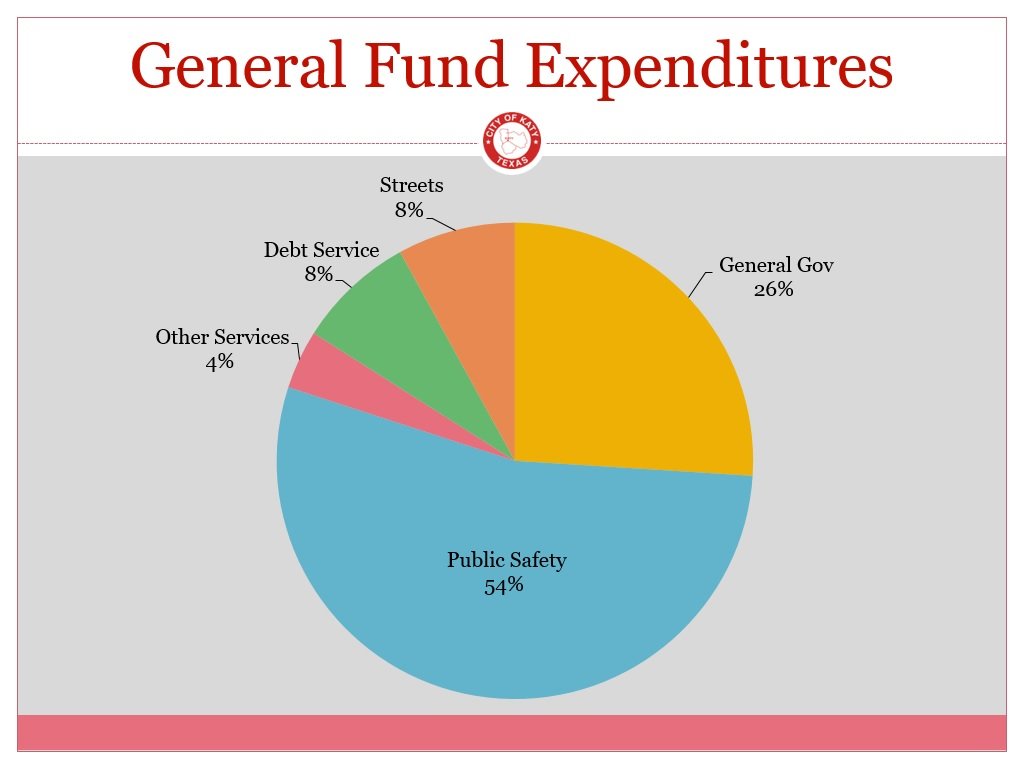

The overall budget is a $2.9 million, or 5.68% increase, from last year’s $52 million budget. Officials said they anticipated a 4% salary adjustment starting next month. Public safety comprises 54% of the total general fund budget, which is an increase from previous years. These changes, as the city competes with other cities to hire and retain public safety employees such as police officers, paramedics and firefighters.

The budget calls for the addition of six full-time employees. These positions include a patrol officer, a paramedic/firefighter, street maintenance worker, permit clerk, museum coordinator and fleet mechanic.

This year’s budget is notable from those of recent years in that the city is not responding to natural disasters such as Hurricane Harvey in 2017 or winter storm Uri in 2021, or the pandemic. But Hebert earlier this month said city staff is prepared for what he called a “proactive response” to several catastrophic scenarios.

Council Member-at-Large and Mayor Pro Tem Chris Harris said the budget makes investments in drainage, street repairs, public safety and parks, among other items.

“I know our finance department and city administrator have worked long on this budget,” Harris said.

City revenues, Hebert said, have not been impacted near projected worst-case scenarios, but the city is restoring the budget slowly to pre-COVID conditions as possible. He said the goal was not to deplete services while preserving a balanced budget and raising taxes only as a last resort.

The budget and tax rate were adopted following public hearings in which nobody spoke.

Keywords

City of Katy, Katy City Council, budget